Here are some prevalent fraud schemes that are likely to continue through July 2025:

Forward spam or phishing emails to reportphishing@apwg.org. If you suspect a fraudulent text message, forward it to SPAM (7726).

1. Common Scams:

* Imposter scams: Scammers may pretend to be from businesses, government agencies, or even people you know (like family members in emergencies) to get money or information. This includes business imposters, government imposters (like those claiming to be from the IRS or Social Security), and grandparent scams. Note that ERS will only contact you if you’ve reached out first; check for the official ERS logo on mail. Also be aware of DEA impersonation scams.

* Online Scams: These can include fake online stores and websites, ticket scams, and tech support scams where fake pop-ups claim issues and demand payment.

* Money-Making Scams: Be cautious of job scams requiring upfront fees, investment scams often starting through unsolicited online connections, lottery fraud demanding fees for a fake prize, and romance fraud where scammers feign interest to get money.

* Scams related to summer activities are common, such as fake vacation rental listings, home improvement scams with upfront payment demands for poor work, moving scams with hidden fees, and ticket scams from unofficial sources.

* Door-to-door scams can increase in the summer, with impersonators posing as utility workers or salespeople. Be vigilant for post-storm contractor scams where fraudsters vanish after taking payments for repairs.

* Keep an eye out for scams enhanced by artificial intelligence (AI), including more convincing phishing attempts and voice cloning. AI is also being used to create fake identities for synthetic identity fraud. Account takeover fraud, particularly on digital payment platforms, is also a concern.

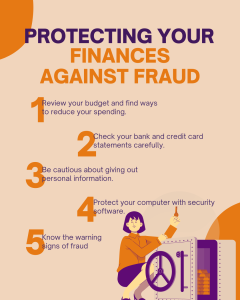

- Be cautious of unsolicited contact and verify the identity of anyone claiming to be from a business or government agency.

- Avoid clicking on suspicious links in emails or texts.

- Protect your online accounts with strong passwords and multi-factor authentication.

- Regularly check your financial accounts for unusual activity and consider freezing your credit if you suspect identity theft.

- Stay informed by following consumer alerts from the FTC and the Texas Comptroller’s office.

- Report any suspected fraud to the FTC at ReportFraud.ftc.gov, the Office of the Texas Attorney General, or the Texas Comptroller’s office. Forward spam or phishing emails to reportphishing@apwg.org. If you suspect a fraudulent text message, forward it to SPAM (7726).